First sight of ECB interest rate cut(s)

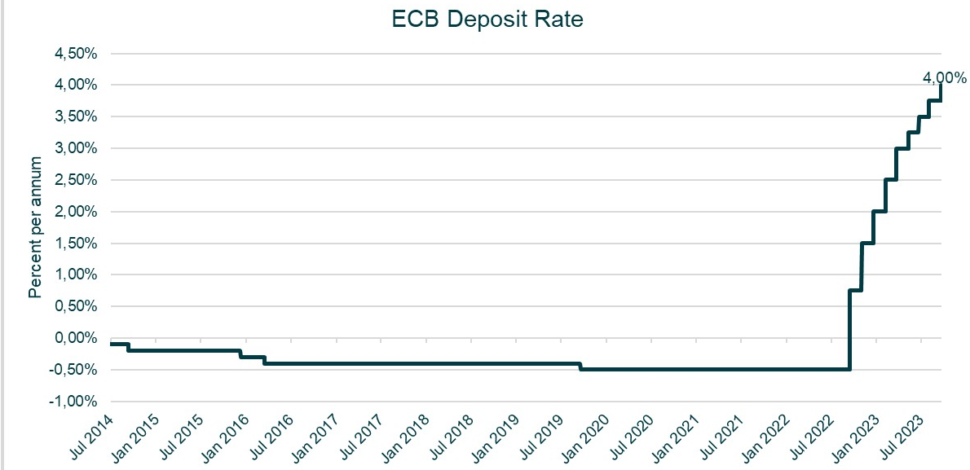

After a long period of minimal and ever-declining interest rates, central banks started a series of interest rate hikes in 2022 in an effort to fight rising inflation. The US Federal Reserve (“Fed”) took the first step in March 2022. The ECB followed suit in July 2022 with an increase in its key policy rates – for the first time in 11 years. The ECB deposit rate (the interest rate on the deposit facility, which banks can use to place deposits with the ECB) rose from minus 50 basis points to its current record level of 400 basis points in 14 months.

There are a number of indicators that suggest that more rate hikes are not imminent, but rather that interest rates will soon fall again:

- After a series of increases, the ECB decided to leave interest rates stable (for now). The Fed also signaled on November 1st, not to raise interest rates further, for now.

- Meanwhile, Eurozone inflation fell sharply: annual inflation was still at 4,3% in September, but has come down to 2,9% in October. This brings current inflation near the target of 2,0%.

- As historically demonstrated, rising unemployment makes it easier to contain inflation. Unemployment is currently still very low yet slightly rising again, especially in the US.

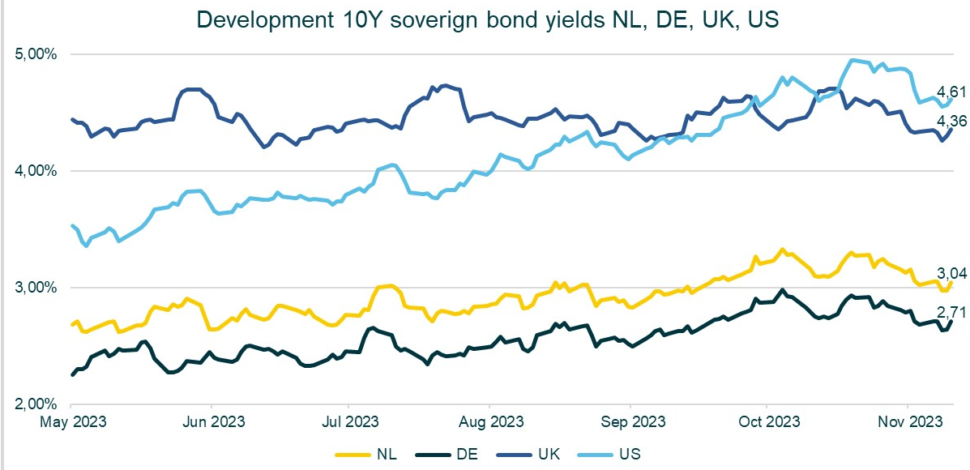

The latter two indicators are key drivers of longer-term interest rates in the market. Longer interest rates are not set by central banks, but are the result of supply and demand in the capital market. We now see 10-year government bond yields in major European countries and in the US falling after a long period of rising interest rates. This shows that the market expects short-term interest rates to fall again, too.

How does this work? We can infer this from short-term interest rates (forward rates). We can observe forwards indicating what the market expects for 1-year interest rates in 1 year, in 2 years, in 3 years, and so on. From the fact that we now see long-term interest rates falling, we can infer that like-for-like the market expects short-term interest rates to also fall in the long run.

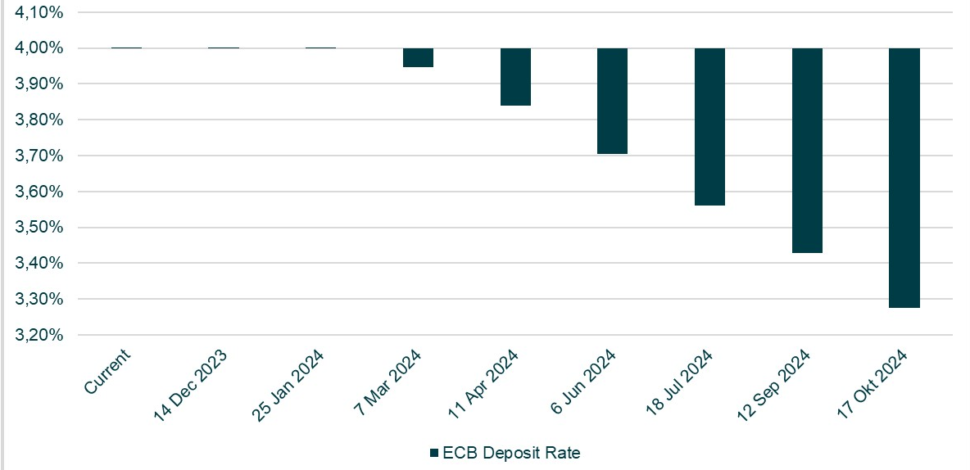

Financial news agency Bloomberg has carried out an analysis of these forward interest rates. Their conclusion is that an interest rate cut can be expected for the first time in March 2024, and then interest rates may gradually be reduced further thereafter. One year from now, deposit rates are expected to be around 300 basis points.

Of course, we should note here that market expectations change daily and this is a snapshot in current time. However, we can conclude that the clear difference between short-term and longer-term interest rates indicates that, at least for now, there is a broad consensus that interest rates are going to fall.

What does this mean for our clients?

The falling yield curve mentioned earlier may have an impact on your funding costs. This could happen; 1) in the longer term, if the lower interest rates predicted by the futures market lead to lower interest rates in 2024; or 2) in the shorter term, for instance when taking out an interest rate swap or a fixed-rate loan. In that case, you will find that interest rates for longer maturities are lower than short-term (euribor) rates.

Do you have any questions about how the discussed developments might impact your company? Contact our experts in this field: Derek Venneman and Alwin de Haas.