Can you hedge interest rate risk if you have not secured financing yet?

Depending on their company’s situation, our clients follow the financial markets more or less closely, but in today’s volatile market, interest rate developments are followed by many on a daily basis. For clients who are about to take out new financing, the base interest rates (euribor and the interest rate swap) and also the development of the credit margins are particularly important.

Regular refinancing

In the case of regular refinancing, we often see that clients (and banks) can “time” it to some extent. You don’t have to wait until year 5 to refinance your 5-year facility. If the market is favorable, i.e. credit margins are relatively low, you can refinance as early as year 3 or 4. In that case, the gain from a lower credit margin more than compensates the extra upfront costs. Since the lead time of a refinancing is relatively limited, the risk of a rising base rate is not open for too long.

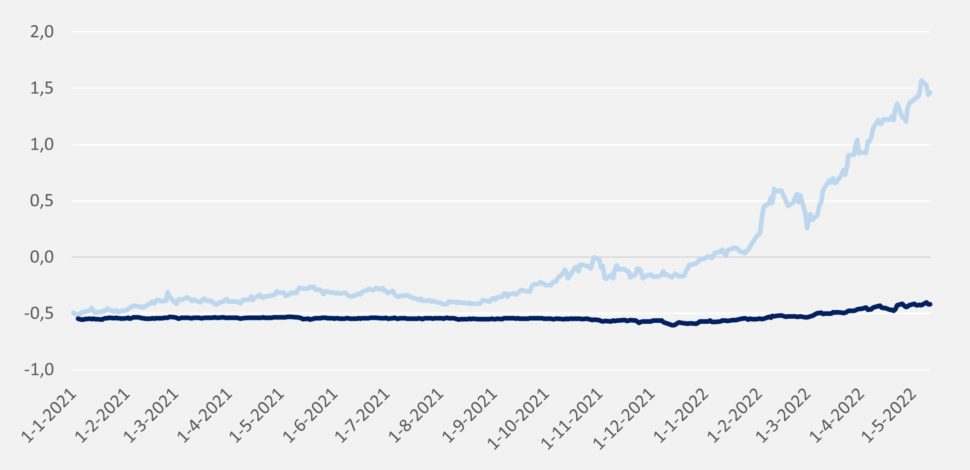

Nowadays we see that even a period of 2 to 3 months can mean a lot for the euribor and swap rates, look for example at the year-to-date chart below of the 3-month euribor and the 5-year swap rate.

Interest rate risk in an acquisition or major investment

In other words, in a normal planned refinancing, interest rate developments are already important because of the potential financial impact on the company. But what about when a company is engaged in a transformative transaction, such as a major investment or acquisition? There are a number of factors at play here that make managing interest rate risk extra difficult and at the same time extra important.

Often long period of uncertainty

In a transforming transaction, the hedge issue is especially tricky because of the uncertainty about whether the transaction will go through at all. In an M&A transaction, this is immediately obvious; the deal is not done until the fat lady sings. But even with a major investment, we often see that it is preceded by a period of uncertainty that can last a very long time. Will the company get the necessary permits? Will any grant process be completed properly? Does the project’s budget still balance with the contractor’s rising price? And finally, does the company get the final “go” from its stakeholders?

Great importance of mitigating risk

At the same time, risk mitigation is of great importance. Firstly, an acquisition or major investment is often accompanied by a relatively large amount of additional financing, which is also taken up for a longer period. This means that the additional interest rate risk this brings for the coming years will quickly become significant for the company in absolute terms (measured in EUR).

Secondly, we see that this additional financing increases leverage. With a higher leverage it makes sense to build in more certainty with respect to the risks outside the operational sphere. This means that the additional financing also leads to a need to hedge the interest rate risk along that way. In this situation, we often see banks wanting a (significant) portion of the interest rate exposure to be hedged.

To summarize, taking out a hedge in a transforming transaction is important because the interest rate risk often involves a lot of money and managing this risk – with a higher leverage – is especially important. However, we also indicated above that, at the same time, we need to find a way to deal with the uncertainty about whether the transaction will go through.

Hedging uncertainty

In addition to these “internal” concerns, there is also an important “external” element associated with the previously mentioned uncertainties. As long as the transaction and related financing are not 100% certain, it often proves very difficult to close an interest rate hedge transaction with the bank.

This applies primarily to interest rate swaps, where as a result of market value development, a liability may arise from the customer to the bank. With financing that is uncertain, this is a risk you should want to avoid as a business owner. The same is true for the bank. They also want to avoid having a credit risk from an interest rate swap associated with a financing that never went through. In our earlier article, we noted in that context that banks no longer want “loose swaps” on their books. A trend that, by the way, not only stems from the sympathetic concern of your banker, but also from the duty of care on which the bank is monitored and which obliges the bank to ensure that you only hedge existing risks and do not (inadvertently) create new additional risks with derivatives.

The above implies that the hedge solution must usually be sought in the options sphere, such as the purchase of interest rate caps or a swaption.

| Interest rate cap: purchase of an interest rate cap protects the company against an increase in the euribor interest rate component of its borrowing costs during the maturity of the financing. Above an agreed “strike,” the increase in euribor is reimbursed 1-to-1 by the bank. For this, the company pays an upfront premium. A lower strike or a longer maturity leads to a more expensive interest rate cap. Swaption: purchase of a payer swaption (swap option) protects the company from the increase in swap rates when it intends to enter into a payer swap at a known future time. The swaption is an option to enter into a swap at a pre-agreed swap rate, which is the strike of the swaption. This option is usually cash-settled when it is “in the money” at the end of the term. The amount the company receives in that case is equal to the additional costs it will incur in the future as a result of swap rates in the market rising above the agreed strike. Again, the premium is paid upfront, and a lower strike or a longer option maturity results in a higher premium. |

Even when using options, the bank’s duty of care requires that you can show that the desired options are a good match for the modalities of your financing (size, maturity, base rate, etc.). Since, however, from the purchase of an option (irrespective of whether it is an interest rate cap or a swaption), by definition, an obligation from the client to the bank can never arise, the bar is somewhat lower here and they can often be arranged, if the transaction and financing are not yet 100% certain. Under certain conditions, it is even possible to include the purchase cost of options (the “premium”), and the result when they are exercised, in the interest costs over the maturity of the financing through hedge accounting.

Given the rise in interest rates in recent months and its acceleration since the war in Ukraine, interest rate hedging is also a hot topic in uncertain exposures due to ongoing M&A transactions or large investment projects. In recent weeks, we have therefore assisted several clients in their analysis and negotiation/execution of transactions to hedge their not-yet-100%-secure interest rate risk through options.

We would be happy to discuss with you your company’s interest rate risk and the opportunities to manage this risk.