A payment framework for Treasury

Payments and payment processing are becoming more and more important for corporations. International growth, developments in technology, compliance and cyber security are significant challenges for payment handling.

The ability to process payments in a secure, controlled, and optimized manner has always been key to Treasury. Next to processing high value payments, often related to financing or settlement of derivatives, the secure and efficient delivery of bulk/low value payments is also often considered a treasury responsibility and included in an inhouse bank or payment factory solution.

For processing high value payments Treasurers rely on different elements:

- information and triggers to create the payment;

- control mechanisms to verify and approve the payment;

- internal IT systems that support the process from invoice to payment initiation and routing;

- a banking infrastructure that has the appropriate geographic coverage.

For bulk/low value payments to pay vendors or other third parties, efficiency is of major importance. Payments should not only be processed securely, on time and with low risk, but also against lowest cost.

How the Orchard Finance payment framework supports Treasury organizations

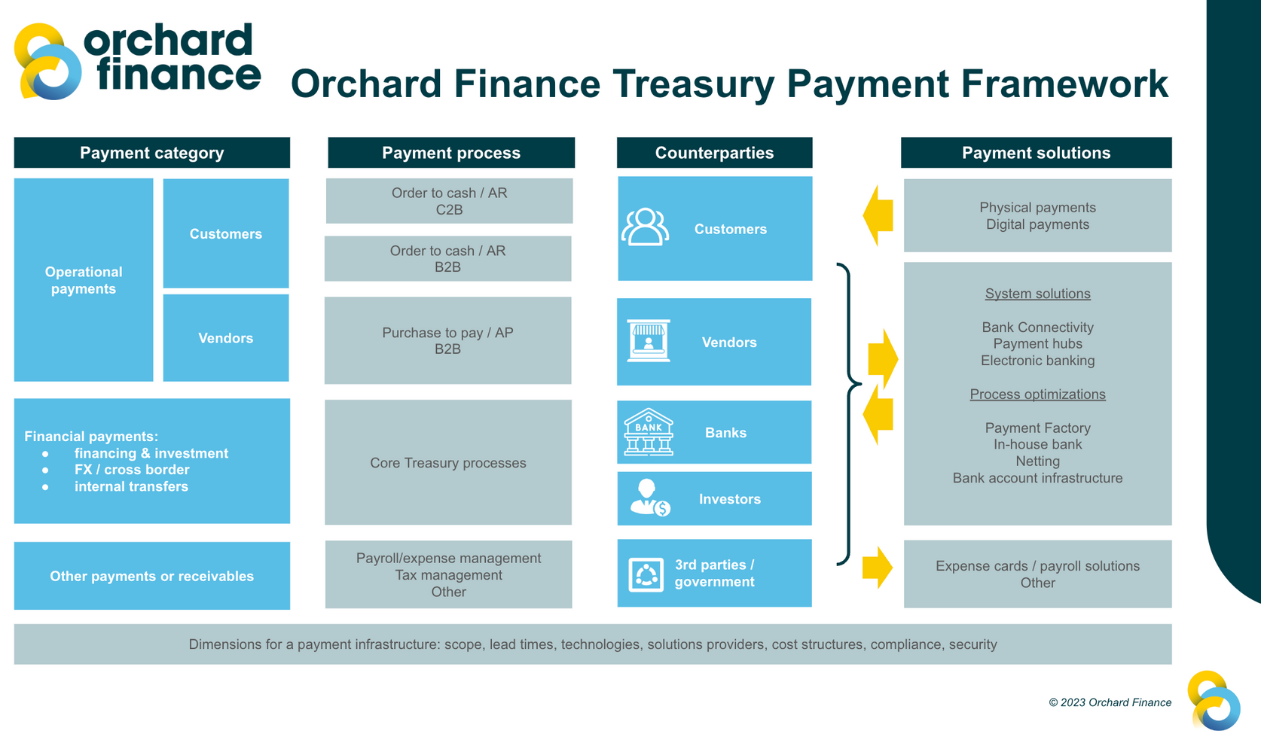

Orchard Finance’s payment framework can help Treasury organizations to assess what payment flows are important to ensure full visibility and control.

Trends and innovations in the payment landscape

Due to the rise of e-commerce, accelerated during the pandemic, development of online payment methods for consumers is ongoing. For most companies working together with multiple payment service providers is no longer an exception. Traditionally, the responsibility for managing these merchant service companies is with the commercial teams that are responsible for the online customer journey. When optimizing and streamlining the customer payment process the main focus is on sales conversion. However, this should also be part of the Treasury remit as it relates to financial flows and financial counterparty risk.

Many new payment initiatives started from a consumer perspective (e.g. SEPA, PSD2, instant payment, BNPL, CoP, P27) and are driven by regulation. At the moment, usage of crypto currencies as a payment method is limited. However, central banks are analyzing options for Central Bank Digital Currencies. Once further developed, these initiatives could become an alternative payment method directly supported by Central Banks and based on blockchain technology. The main challenge, next to the (im)maturity of the technology, is how these processes can be regulated and made secure. It is also interesting to learn how these processes would work cross-border and how ‘dark web’ usage can be restricted.

Realtime cash visibility will become available when processes are adapted to APIs. Banks and technology companies are migrating from daily bulk processing as a default to offering real time solutions.

To ensure full cash visibility and control a treasurer should pay close attention to all cash flows. Payment solutions can support in optimizing payment flows and related dimensions.

Ariane Hoksbergen is Partner Treasury Technology at Orchard Finance and responsible for Treasury Technology Advisory, including selection and implementation of different technology solutions.