Cash Flow forecasting – a timeless Treasury crown jewel?

Why is it that cash flow forecasting continues to be listed, for a number of years already, as top priority for Treasurers according to several surveys? What is the difference between the forecasting process performed by Treasurers compared to forecasting exercises performed by Control departments? What are the current trends related to cash flow forecasting? This article discusses these questions. It concludes with important key success factors for setting up a (new) cash flow forecasting process within an organization.

What is cash flow forecasting and what are the benefits

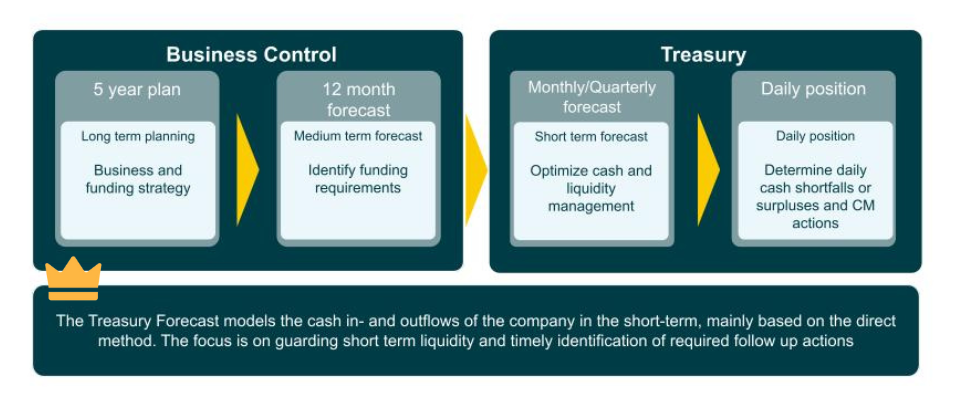

Cash flow forecasting is the process in which we predict future incoming and outgoing cash flows over a defined period. Cash flows are allocated to relevant categories reflecting key business drivers. Controllers often forecast based on the indirect method (forecast based on net income with adjustments for non-cash items like depreciation, changes in inventory, and changes in receivables/payables). Treasurers mainly use the direct method for cash flow forecasting. With this method, actual cash flows and transactions are forecasted.

The benefit of this method is that the development of actual cash positions are forecasted, allowing for effective decision-making in the different treasury processes.This may include funding and investments, optimized cash management, dynamic risk management and scenario analyses. Furthermore, the insights from the process function as an important signal as deviations in the forecast can be identified (near) real-time and are not necessarily dependent on accounting processes (which are – by nature – subject to delays).

A solid cash flow forecasting process does not only deliver a strong foundation for effective (strategic) decision-making, but also the ability to identify and adapt to changing circumstances, market conditions or priorities in a proactive manner. It increases control and enhances stakeholder confidence. In today’s world where volatility and uncertainty seems to be the only constant, cash flow forecasting is a crucial process. A precious jewel to be cherished in the Treasurer’s toolkit.

Trends in treasury

There are several treasury trends impacting cash flow forecasting. A first trend is that Treasury functions continue to evolve, moving beyond a day-to-day operational treasury to an active contributor to strategic decision-making with a broader stakeholder focus. One example is related to working capital optimization and the relation with control, P2P, O2C and supply chain departments. The insight of how changes in receivables, payables, and inventory directly impact cash flow is crucial for effective integrated working capital management and optimization.

Technological advancements are a second trend. They play a pivotal role in facilitating this evolution. Tools that provide more accurate, granular and timely insights have become the standard. The integration of artificial intelligence (AI) and big data has further transformed the landscape and enhanced the opportunities for setting up a cash flow forecasting process. The AI capabilities in pattern recognition and predictive analysis, leverage the use of historical data.

And what is to be expected from applying “generative AI” whereby new content can be created based on learned patterns. Generative models learn from large historical data sets, empowering treasury teams to make better decisions using AI generated content. Integrated data, connecting to bank systems and Enterprise Resource Planning systems (ERPs), ensures a seamless flow of information. Real-time data, facilitated by instant payments and Application Programming Interfaces (APIs), is becoming increasingly prevalent, providing treasury teams with up-to-the-minute insights.

A third trend relevant for Treasurers is the converging technological landscape. Next to the integrated Treasury Management Systems, a range of best-of-breed solutions is available, purely focussing on cash flow forecasting functionality. The cash flow forecasting functionality in the integrated solutions versus best-of-breed solutions is converging.

Success factors for cash flow forecasting

Successful cash flow forecasting requires timely and accurate data availability, collaborative efforts with other departments and stakeholders, and the integration of forecasting with clear business goals. It also requires an adaptive mindset to make sure that changing circumstances are identified and incorporated into the process.

Establishing a robust framework comprising empowered team members, streamlined processes, and effective tools is crucial for analyzing forecast versus actuals and taking appropriate actions. The determination of the appropriate granularity tailored for specific business needs ensures a fit-for-purpose analysis, collectively contributing to informed decision-making and sound financial management.

By addressing these factors, organizations can enhance the effectiveness of their cash flow forecasting. Don’t keep this treasury crown jewel unused, but instead leverage it to maximize its added value.

This article is published by Esther Goemans-Verkleij, Partner Treasury at Orchard Finance.

Let’s get in touch!

If you are interested or want to get to know more, don’t hesitate to contact our expert on this topic:

Esther Goemans-Verkleij

Partner Treasury